3rd Party Validation

- Strategic Investor: Fortescue Ltd. has acquired 31% of Alta Copper

- RFC Ambrian: Cañariaco Norte in top 10 of 23 Projects with potential to involve third party M&A (December 2021)

- Haywood: Cañariaco Norte one of 18 assets selected as likely to be considered by Majors looking to Acquire (December 2021)

- Goldman Sachs: Cañariaco Norte identified as one of the top 84 copper projects worldwide (October 2018)

- Deutsche Bank: Cañariaco Norte identified as one of 3 projects required to meet the upcoming copper supply-demand gap (February 2021)

3rd Party Validation Presentation

Fortescue, one of the largest global iron ore producers recognized for its innovation and industry-leading development of world class infrastructure and mining assets, has acquired 31% of the Company. Fortescue was granted the right to:

- Appoint a director of Alta Copper, appointed Christine Nicolau

- Right to Participate, on a pro rata basis, in any future equity financing of equity securities

- Right of First Refusal to provide a Non-Equity Financing (debt financing or a royalty or stream for any of Alta Copper’s assets), prior to May 2022

- Technical Committee formed to Optimize the Development of the Project

Fortescue's recent Australian exploration activity has focused on early-stage target generation for copper-gold in addition to its extensive iron ore deposits in Western Australia. It is simultaneously building on its world-class exploration expertise, operational reputation and capability through exploration in highly prospective areas such as Peru.

RFC Ambrian

- Cañariaco Norte is the 10th largest late-stage copper resource in the world

- While Cañariaco Norte is the 10th largest, it contains the 6th highest copper grade

- Cañariaco Norte listed as a copper project with takeover potential

Haywood Securities

- Cañariaco Norte very well positioned as one of the largest copper resources with above average grades

- Cañariaco Norte large NPV compared to peers, but also high CapEx [Ausenco 2021 PEA in progress to improve ESGs with lower CapEx - expeded January 2022]

Goldman Sachs

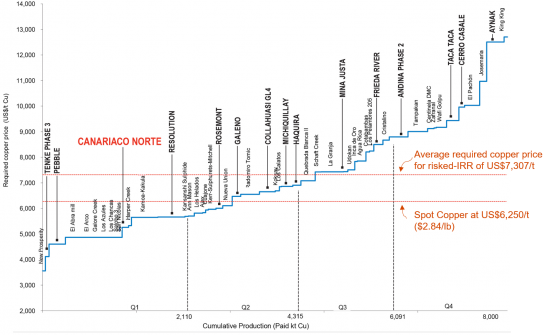

- GS identifies Cañariaco within top 84 copper projects worldwide (42 are located in South America) set to form >75% of new copper supply near future: >80% of unapproved projects are uneconomic at current prices

- Rise in incentive prices (copper price required to bring projects online) – due to rising costs/capex, increasing consumable costs

Deutsche Bank Research - Attractive projects likely to get increased attention

“Large-cap miners have limited growth options whereas a number of attractive copper projects we have analyzed are owned by companies with limited financial means and/or technical know-how. With copper having one of the strongest fundamentals, we believe that strategic buyers (large-cap miners, China Inc) will lead the approaching consolidation phase. “

“There are a number of other attractive projects we have identified which we believe will be required to meet the upcoming supply-demand gap (e.g. SolGold's Alpala, Alta Copper's Cañariaco Norte and Capstone's Santo Domingo).